Corporate Governance

- Outstanding Shares

-

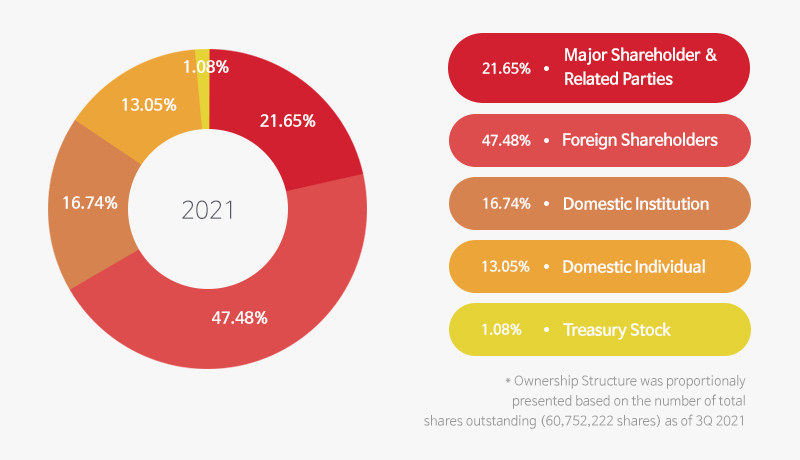

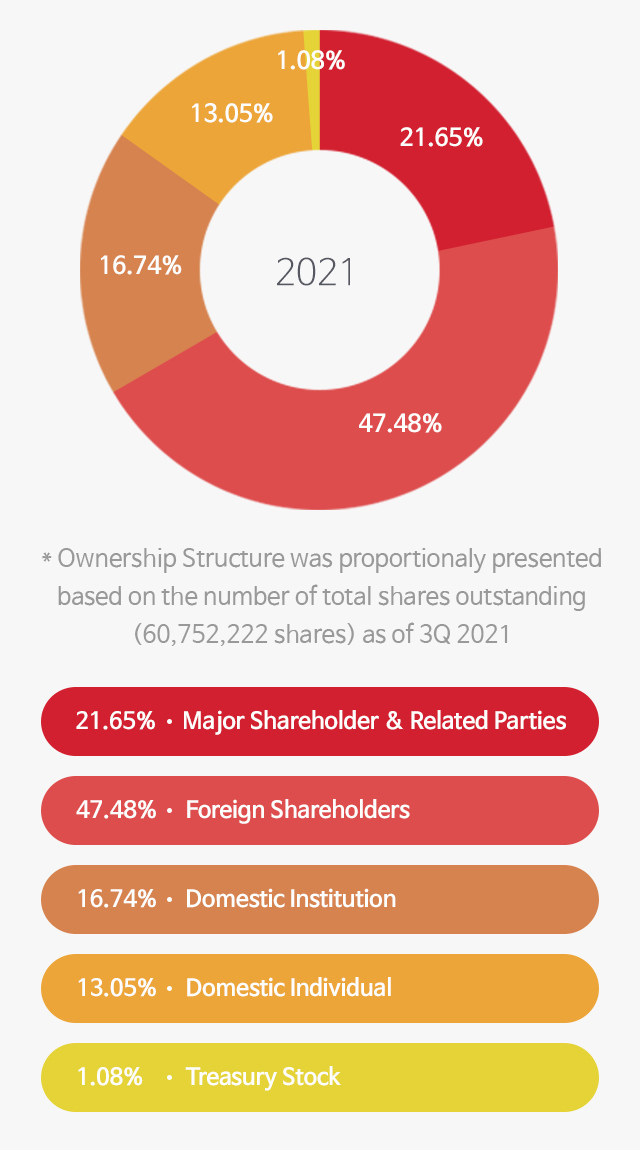

As of Sep 30th 2021, the number of total shares outstanding is 60,752,222.

The total outstanding shares are 100% common shares.

- Ownership Structure (as of Sep 30th, 2021)

-

- List of Shareholders with

the Ownership of 5% or above(as of Sep 30th, 2021) -

(Unit:Shares,%)

Name Number of Shares Proportion Piemonte Co.,Ltd and 2 others 13,151,478 21.65% National Pension Service 5,956,215 9.80% Templeton Asset Management, Ltd. 3,037,753 5.00%

Board of Directors

Directors

-

Yoon-soo Yoon

ChairmanAppointment Date : Mar. 2020

Term : 3 years

Chairman -

Keun-Chang Yoon

Appointment Date : Mar. 2019

Term : 3 years

President and CEO -

Myoung-Jin Yun

Appointment Date : Mar. 2021

Term : 3 years

Global Planning -

Seung-Yug Chung

Appointment Date : Mar. 2021

Term : 3 years

COO, FILA Korea Ltd.

Independent Directors

-

Suk Kim

Appointment Date : Mar. 2019

Term : 3 years -

Hae-Sung Kim

Appointment Date : Mar. 2021

Term : 3 years -

Young-Mi Yun

Appointment Date : Mar. 2021

Term : 3 years

※ Take out Directors and Officers Liability Insurance (Sep. 2021)

| Session | Date | Agenda |

| 1 | 2020-01-02 |

(1) Approval on announcement that substitutes the vertical demerger report on the general meeting. (2) Approval on the conclusion of agreement on the transaction of business after vertical demerger (3) Approval on a joint guarantee of financial liabilities transferred to a new split company (4) Approval on conclusion of asset transfer agreement between FILA Holdings Corp. and Piemonte Co.,Ltd. (5) Approval on conclusion of management advisory service contract between FILA Holdings Corp. and Subsidiarys (6) Approval on changing the location of the headquarters |

| 2 | 2020-02-14 |

(1) Report on operational status evaluation of internal accounting control system (2) Report on operation result of compliance policy (3) Approval on preliminary financial results of FY 2019 (4) Decision on cash dividend of FY 2019 (5) Decision on calling General Shareholders' Meeting of FY 2019 (6) Recommendations of candidates for directors. (7) Approval on conclusion of sublease agreement |

| 3 | 2020-02-28 |

(1) Approval on retirement of treasury stocks (2) Approval on establishment of FILA Singapore Holdings Pte. Ltd. and FILA Malaysia Corporation |

| 4 | 2020-03-19 | (1) Report on audited financial statements of FY2019 |

| 5 | 2020-03-23 |

(1) Approval on loans between affiliates. (2) Approval on treasury stock buyback |

| 6 | 2020-03-31 |

(1) Apporval on execution of general loan from shinhan bank (2) Apporval on execution of limit loan from shinhan bank |

| 7 | 2020-04-08 | (1) Apporval on execution of limit loan from Korea Development Bank |

| 8 | 2020-04-14 | (1) Apporval on execution of working capital loan from Woori Bank |

| 9 | 2020-04-22 | (1) Apporval on execution of general loan from NH Bank |

| 10 | 2020-05-15 | (1) Report on business performance of FY2020 Q1 |

| 11 | 2020-06-22 |

(1) Approval on conclusion of asset transfer agreement between FILA Holdings Corp. and FILA Sport (Hong Kong) (2) Apporval on execution of foreign currency loan from shingan bank |

| 12 | 2020-07-27 | (1) Apporval on Standard Charted Bank of Korea to extend the expiration of foreign currency loans |

| 13 | 2020-08-12 |

(1) Report on business performance of FY2020 Q2 (2) Apporval on revision of Compliance Policy (3) Apporval on reappointment compliance assistant |

| 14 | 2020-09-24 | (1) Apporval on extension of maturity of treasury stock acquisition trust contract |

| 15 | 2020-11-12 |

(1) Report on business performance of FY2020 Q3 (2) Approval on conclusion of asset transfer agreement between FILA Holdings Corp. and Montebelluna Limited (3) Approval on revision of board of directors operation regulations (4) Approval on revision of disclosure information management regulations |

| 16 | 2020-12-16 |

(1) Budget Review on FY2021 (2) Apporval on Korea development bank to extend the expiration of general loans |

Comparison with Corporate Governance Best Practices

The 31st General

Shareholders' Meeting

- Date

- March 30, 2021 (Tuesday) 9:00 a.m

- Place

- Convention Hall, 15th floor, East Central Tower, 1077 Cheonho-daero, Gangdong-gu, Seoul

Exercised Vote at the 31st

General Shareholders'

Meeting of

FILA Holdings Corp.

FY 2020 : January 1, 2020 to December 31, 2020

- Number of outstanding shareholders : 60,752,222

- Number of shares with voting rights : 60,095,839

- Number of shareholders attending

the general shareholder’s meeting

(exercise of voting rights) : 43,639,983

- Voter turnout : 50.7%

(excluding the largest shareholder and

affiliated persons)

No.

Agenda

Approval Rate

Result

-

-Agenda No.1

Approval on FY 2020 Consolidated Financial Statements

(including the statement of appropriation of

retained earnings)

(Jan. 1, 2020 ~ Dec. 31, 2020)93.6%

Passed

-

- Agenda No.2

Appointment of Directors

-

- Agenda No.2-1

Appointment of Executive Director(Myoung-Jin Yun)

98.5%

Passed

-

- Agenda No.2-2

Appointment of Other Executive Director(Seung-Yug Chung)

96.1%

Passed

-

- Agenda No.2-3

Appointment of Independent Director(Hae-Sung Kim)

99.3%

Passed

-

- Agenda No.2-4

Appointment of Independent Director(Young-Mi Yun)

99.8%

Passed

-

- Agenda No.3

Appointment of Internal Auditor (Young-Sun Yoon)

92.9%

Passed

-

- Agenda No.4

Approval of Limit on Renumeration of Directors

85.8%

Passed

-

- Agenda No.5

Approval of Limit on Renumeration of Internal Auditor

99.9%

Passed

Articles of Incorporation / Corporate Governance Charter

Article 1 Corporate Name

The name of the Company shall be 휠라홀딩스 주식회사 in Korean, and FILA HOLDINGS

CORPORATION in English.

Article 2 Objective

The objective of the Company is to engage in the following businesses:

1. Acquisition, possession and management of shares or equity in subsidiary company, etc. and related businesses; business as a holding company which controls, provides managerial support to, withdraws or promotes any and all businesses of subsidiary company;

2. Business management and technical representative business;

3. Administrative support business for the joint development and sale of goods or services and joint utilization of facilities and computer systems, with the subsidiary company, etc.;

4. Business of consignment work of the subsidiary company, etc. including planning, accounting, legal affairs, computing, etc.;

5. Financial and business support for the subsidiary company; financing business necessary for providing financial support;

6. Education and training service business for the subsi

diary company, etc.;

7. Rental and provision of brands, licenses, etc.; 8. Sale, rental and service business of intangible assets held by the Company including knowledge, information, patent rights, utility model rights, design rights, trademarks, brand rights and copyrights, etc.;

9. Market survey, business management advisory service, and consulting business;

10. Technical research, provision of technical information and service outsourcing business;

11. New project investment, management and operation business;

12. New technology-related investment, planning and management business and startup support business;

13. Trading business for underwear, outerwear, shoes, bags, cosmetics, etc.;

14. Underwear wholesale and retail business;

15. Outerwear wholesale and retail business;

16. Shoes wholesale and retail business;

17. Technical tests, examinations and analysis business which are not otherwise classified;

18. Home fabrics, garments, shoes and leather goods wholesale and retail business which are not otherwise classified;

19. Bags and travel goods wholesale and retail business;

20. Cosmetics wholesale and retail business;

21. Watches and sunglasses wholesale and retail business;

22. Manufacturing business (clothes, leather goods, shoes, accessories, cosmetics, watches, sunglasses, etc.);

23. Golf equipment wholesale and retail business

24. Real estate sale, lease, storage, development and unit sale business;

25. Information management and sale business; and

26. Any and all business incidental to the foregoing.

Article 3 Location of Head Office and Branches

(1) The head office of the Company shall be located in Seoul, Korea

(2) Domestics and overseas branches, liaison offices, business offices and local subsidiaries may be established by the Company by a resolution of the Board of Directors, whenever necessary.

Article 4 Method of Public Notices

Public notices of the Company shall be given by publication at the Company’s website (http://www.filaholdings.com). However, if the public notices of the Company may not be given at the Company’s website due to problems with computer system or any other unavoidable reasons, such notices shall be given in the Korea Economic Daily, a daily newspaper of general circulation published in Seoul.

Article 5 Total Number of Authorized Shares

The total number of shares, which the Company is authorized to issue, shall be 200,000,000 shares.

Article 6 Par Value

The par value of each share to be issued by the Company shall be 1,000 Won.

Article 7 Shares to be issued at the time of incorporation

The total number of the shares to be issued by the Company at the time of incorporation shall be 70,000 shares.

Article 8 Classes of Shares

(1) The class of shares to be issued by the Company shall be comprised of common shares and preferred shares in registered form.

(2) Preferred shares to be issued by the Company shall be non-voting on all general resolution of a General Meeting of Shareholders, and to the extent that the total number of the preferred shares to be issued by the Company shall not exceed 1/2 of the total number of issued and outstanding shares, to the extent permitted by the relevant laws and regulations.

(3) For preferred shares, stimulated dividend ratio shall be determined by the Board of Directors, at the time of issuance of stock. In such a case, stimulated dividend ratio shall be determined by the Board of Directors, considering the necessity of financing, market situation and any other reasons in connection with issuing class shares. However, as a rule, the ranking of dividend between preferred shares is in the same rank, but may be differently determined by a resolution of the Board of Directors, at the time of issuance of stock.

(4) If the dividend rate of common shares exceeds the dividend rate of preferred shares, the excess portion can be chosen as a participating or non-participating preferred shares by a resolution of the Board of Directors, at the time of issuance of stock.

(5) In the case of conducting new shares or bonus shares, or stock dividends by the Company, for common shares, regarding on the preferred shares, the Company shall issue preferred shares in the same conditions, depending on the ratio of the shares held by any shareholders, as a rule. However, the Company may issue single type of shares by a resolution of the Board of Directors, according to the need. In such a case, all shareholders have rights to be allocated or dividend for issued shares.

Article 9 Types of Share Certificates

Share certificates of the Company shall be issued in eight denominations of one (1), five (5), ten (10), fifty (50), one hundred (100), five hundred (500), one thousand (1000) and ten thousand (10,000) shares.

Article 10 Preemptive Rights

(1) Shareholders shall have preemptive rights to subscribe for any new shares that may be issued by the Company, in proportion to their respective shareholdings.

(2) Notwithstanding the provision of Paragraph (1) above, new shares may be issued to any person(s) other than the shareholders of the Company by a resolution of the Board of Directors, if the Company:

1. Issues new shares by stockholder’s preference in public offering;

2. Issues new shares by public offering to the extent that the number of such new shares does not exceed 50/100 of the total number of issued and outstanding shares;

3. Issues new shares to domestic or overseas financial institutions or institutional investors to raise emergency funds to the extent that the number of such new shares does not exceed 20/100 of the total number of issued and outstanding shares;

4. Issues new shares to its business partners for acquisition of a certain technology, R&D, manufacturing, sales and capital to the extent that the number of such new shares does not exceed 20/100 of the total number of issued and outstanding shares;

5. Issues new shares in accordance with issuance of depositary receipts (DR) to the extent that the number of such new shares does not exceed 50/100 of the total number of issued and outstanding shares; or

6. Offers new shares to the public or has an underwriter subscribe for such public offering to list share certificates in the stock market to the extent that the number of such new shares does not exceed 50/100 of the total number of issued and outstanding shares.

(3) In the case of issuing new shares in the manner described in any of Paragraph (2) above, the class, number and price thereof shall be determined by a resolution of the Board of Directors.

(4) If a shareholder(s) waives or forfeits his/her preemptive rights to subscribe for new shares or any fractional shares are made in the course of allotting new shares, the method of dealing with such new shares or fractional shares shall be determined by a resolution of the Board of Directors.

Article 11 Stock Options

(1) The Company may grant its officers and employees (including its affiliates’ officers and employees prescribed by Article 30 the Commercial Code; and this shall apply to the relevant provisions below of this Article 11) stock options by a special resolution of a General Meeting of Shareholders, to the extent of not exceeding 15/100 of the total number of issued and outstanding shares. Notwithstanding the foregoing provision, the Company may grant its officers and employees other than the Director of the Company such stock options by a resolution of the Board of Directors, to the extent of not exceeding 3/100 of the total number of issued and outstanding shares; provided, further, that if stock options are granted by a resolution of the Board of Directors, it should be approved at the next General Meeting of Shareholders following the date on which the stock options are granted. Those stock options granted by a special resolution of a General Meeting of Shareholders or a resolution of the Board of Directors may be linked to the performance of the Company measured by targeted managerial results or capital market indices.

(2) Those eligible for a stock option shall be any person who have contributed, or is capable contributing to the Company’s incorporation or management, overseas operation or technological innovation, etc.

(3) The shares to be delivered upon exercise of stock options (or, in case the Company shall pay the difference between the exercise price of stock options and the market price of the shares by cash or treasury share, the shares which shall be the basis of the calculation of such difference) shall be determined by a special resolution of a General Meeting of Shareholders or as resolution of the Board of Directors granting stock options among shares prescribed in Article 8.

(4) The number of officers and employees who are eligible for stock option hereunder shall not exceed 80/100 of the total number of officers and employees then in office in the Company or being employed by the Company and the number of shares covered by a stock option that may be granted to an officer or employee of the Company shall not exceed 10/100 of the total number of issued and outstanding shares.

(5) The per-share price at which stock options are exercised shall not be lower than following prices and this provision shall also apply to where the relevant stock option exercising price is adjusted subsequently after the grant of stock options.

1. If new shares are to be issued and delivered, the higher of the following prices:

(a) The market value of relevant shares evaluated, as of the date of such stock options; or

(b) Face value of relevant shares.

2. If treasury shares are transferred, the market value of relevant shares evaluated, as of the date of such stock options.

(6) A stock option granted hereunder may be exercised within seven (7) years from the date after two (2) years have elapsed from the date when the resolution mentioned in Paragraph (1) above is adopted.

(7) A person who is granted a stock option is entitled to exercise the stock option only he/she has been in office in the Company or employed by the Company at least for two (2) years from the date of the resolution mentioned in Paragraph (1) above; provided, however, that, if the said grantee dies or resigns from the Company within two (2) years from the date of the resolution mentioned in Paragraph (1) above due to the age limit or any other reason not attributable to him/her, such stock option may be exercised within the period originally set for exercising the same.

(8) The provision of Article 12 hereof shall apply, mutatis mutandis, with respect to payment of dividends on the shares issued as a result of the exercise of stock options hereunder.

(9) The grant of a stock option may be cancelled by a resolution of the Board of Directors, if:

1. After the grant of such a stock option, the grantee thereof has resigned voluntarily from the Company;

2. The grantee has caused material damages to the Company by wilful acts or negligence;

3. The Company is unable to respond to the exercise of such a stock option, due to the Company’s bankruptcy, dissolution or otherwise; or

4. There has occurred any event constituting a cause of cancellation thereof as provided in relevant stock option agreement.

Article 12 Commencement Date for Dividends on News Shares

With regard to payment of dividends on the new shares issued by the Company as a result of issuance of new shares or bonus shares, or stock dividends, such new shares shall be deemed to have been issued at the end of the fiscal year immediately preceding the fiscal year to which the time of issuance here belongs.

Article 13 Electronic Registration of Shares and Rights to be Indicated on Preemptive Right Certificates

Instead of issuing share certificates and preemptive right certificates, the Company shall electronically register shares and rights to be indicated on preemptive right certificates in an Electronic Registration Account Book of an electronic registration agency.

Article 14 Transfer Agent

(1) The Company shall appoint a transfer agent in relation to the transfer of its shares.

(2) The transfer agent, its office and scope of services to be provided by the transfer agent on behalf of the Company shall be determined by a resolution of the Board of Director and shall be notified publicly by the Company.

(3) The Company shall have the list of shareholders or a copy thereof kept and maintained at the office of the transfer agent and shall cause the transfer agent deal with electronic registration, management of the list of shareholders and other share-related matters.

(4) The procedure of dealing with such matters as mentioned in Paragraph (3) above shall be subject to the regulation concerning the securities transfer agency by transfer agent, etc.

Article 15 Electronic Shareholders List

The Company shall keep the list of shareholders in an electronic document form.

Article 16 Closing of Registry of Shareholders and Record Date

(1) The Company shall suspend entry of alternations in the list of shareholders with respect to shareholders’ rights from January 1 through January 7 of each year.

(2) The Company shall deem those shareholders whose names appear in the list of shareholders on December 31 of each year to be the shareholders who are entitled to exercise their rights as shareholders at the annual General Meeting of Shareholders to be convened in respect of the said period for the settlement of accounts.

(3) The Company may suspend entry of alternations in the list of shareholders with respect to shareholders’ rights for a given period not exceeding three (3) months, if necessary for convening a General Meeting of Shareholders or otherwise, or the Company may deem those shareholders whose names appear in the list of shareholders on the day specified by a resolution of the Board of Directors to be the shareholders who are entitled to exercise the rights as shareholders in relation to the aforementioned purposes. In such a case, the Board of Directors may designate such a record date, together with suspension of alteration of entries in the list of shareholders, if the Board of Directors deems it necessary. The Company shall give at least two (2) weeks’ prior public notice of such suspension of entry and such a record date.

Article 17 Issuance of Convertible Bonds

(1) The Company may issue convertible bonds to any person(s) other than the Company’s shareholders by a resolution of the Board of Directors in the event of any one of the following;

1. if such convertible bond are issued through public offering or stockholder’s preference in public offering, to the extent that their aggregate par value does not exceed one hundred and fifty billion Korean Won (KRW 150,000,000,000);

2. if the Company issues convertible bonds to financial institutions, domestic and overseas, for the purpose of raising emergency funds, to the extent the their aggregate value does not exceed the amount converting 20/100 of the total issued and outstanding shares; or

3. if the Company issues convertible bonds to any party for the purposes of introduction of advanced technology and R&D or manufacturing, sales and equity which is material to the business, the their aggregate value does not exceed the amount converting 20/100 of the total issued and outstanding shares.

(2) As for the convertible bonds referred to in Paragraph (1) above, the Board of Director may also issue such bonds on condition that only a part thereof be granted the right to convert to capital shares.

(3) The shares to be issued as a result of conversion of such bonds shall be common shares in registered form and the applicable conversion price shall be equal to or higher than the par value per share of such new shares, as determined by the Board of Directors at the time of issuance of such bonds.

(4) The period in which holders of convertible bonds are entitled to make a request for conversion hereunder shall begin on the day after one (1) month have elapsed from the date of issuance thereof and end on the day immediately preceding the maturity date thereof provided, however, that the period for requesting conversion may be adjusted by a resolution of the Board of Directors within the aforementioned period.

(5) As for payment of dividends on the new shares to be issued as a result of conversion hereunder and the payment of interest on such convertible bonds, the provisions of Article 12 hereof shall apply, mutatis mutandis.

Article 18 Issuance of Bonds with Warrant

(1) The Company may issue bonds with warrant to any person(s) other than the Company’s shareholders by a resolution of the Board of Directors in the event of any one of the following;

1. if such convertible bond are issued through public offering or rights offering, to the extent that their aggregate par value does not exceed one hundred and fifty billion Korean Won (KRW 150,000,000,000);

2. if the Company issues convertible bonds to financial institutions, domestic and overseas, for the purpose of raising emergency funds, to the extent that the their aggregate value does not exceed the amount converting 20/100 of the total issued and outstanding shares; or

3. if the Company issues convertible bonds to any party for the purposes of introduction of advanced technology and R&D or manufacturing, sales and equity which is material to the business, to the extent that the their aggregate value does not exceed the amount converting 20/100 of the total issued and outstanding shares.

(2) The amount within which a holder of such bonds with warrant is entitled to request issuance of new shares shall be determined by the Board of Director, to the extent of not exceeding the aggregate face value of such bonds.

(3) The shares to be issued as a result of the exercise of such warrant hereunder shall be common shares in registered form and the applicable price thereof shall be equal to or higher than the par value per share of such new shares, as determined by the Board of Directors at the time of issuance thereof.

(4) The period in which holders of bonds with warrant are entitled to exercise such warrant hereunder shall begin on the day after one (1) month have elapsed from the date of issuance thereof and end on the day immediately preceding the maturity date thereof provided, however, that such a period for exercising warrant may be adjusted by a resolution of the Board of Directors within the aforementioned period.

(5) As for payment of dividends on the new shares to be issued as a result of the exercise of such warrant hereunder, the provisions of Article 12 hereof shall apply mutatis mutandis.

Article 19 Application of Provisions concerning Issuance of Bonds

The provisions of Article 14 hereof shall apply mutatis mutandis to the issuance of bonds.

Article 20 Electronic Registration of Bonds and Rights to be Indicated on Preemptive Right Certificates

Instead of issuing bond certificates and preemptive right certificates, the Company shall electronically register bonds and rights to be indicated on preemptive right certificates in an Electronic Registration Account Book of an electronic registration agency.

Article 21 Time to Convene General Meeting of Shareholders

(1) The Company’s General Meeting of Shareholders shall consist of annual meetings and special meetingsbr

(2) The annual meeting shall be held within three (3) months after the end of each fiscal year and special meeting may be held at any time whenever necessary.

Article 22 Person Authorized to Convene General Meeting of Shareholders

(1) Unless otherwise provided in relevant laws and regulations, a General Meeting of Shareholders shall be convened by the Chairman of the Board elected under Article 41, Paragraph (2) hereof.

(2) If the Chairman of the Board is absent or unable to execute his/her duties, the provisions of Article 41, Paragraph (4) hereof shall apply mutatis mutandis.

Article 23 Personal and Public Notice of Convening General Meeting of Shareholders

(1) In convening a General Meeting of Shareholders, the Company shall give notice in writing or electronic documents to each shareholder of the date, time and place of the meeting and the list of agenda to be dealt with at the meeting, at least two (2) weeks prior to the date set for such a meeting.

(2) For shareholders holding one percent (1%) or less of the total number of issued and outstanding shares with voting rights, the Company may at least two (2) weeks prior to the date set for such a meeting insert twice or more in the Korea Economic Daily and Seoul Economic Daily currently being issued in Seoul or in the Electronic Disclosure System which is operated by Financial Supervisory Service or Korea Stock Exchange a public notice of its intention to convene such a meeting and the list of agenda to be dealt with at the meeting, in lieu of giving such notice mentioned in Paragraph (1) above.

Article 24 Place of Convening a General Meeting of Shareholders

The General Meeting of Shareholders shall be held in the place where the head office of the Company is located and may also be held in any other place adjacent to it, whenever circumstances require.

Article 25 Chairman

(1) The Chairman of the Board elected under Article 41, Paragraph (2) hereof shall preside at all of the meetings of shareholders as chairman.

(2) If the Chairman of the Board is absent or unable to serve as presiding officer, the provision of Article 41, Paragraph (4) hereof shall apply mutatis mutandis.

Article 26 Chairman’s Authority to Maintain Order

(1) The chairman of a General Meeting of Shareholders may stop a person who significantly disturbs order in such a meeting (including with speech or behaviour to interfere with the proceedings of the meeting intentionally) from speaking or may order such a person out of the meeting.

(2) The chairman of a General Meeting of Shareholders may limit the duration and/or the number of times of speech by each shareholder, whenever the chairman deems it necessary for smooth proceedings of the meeting.

Article 27 Shareholder’s Voting Rights

Each shareholder shall have one (1) vote for each share he/she owns.

Article 28 Limitation on the Voting Rights of Cross-held Shares

If the Company, its parent company and subsidiary(s), or a subsidiary(s) of the Company owns more than ten percent (10%) shares of a third company, then the shares of the Company held by that third company shall have no voting rights.

Article 29 Split Exercise of Voting Rights

(1) If a shareholder having more than two (2) votes wishes to split his/her votes at a General Meeting of Shareholders, the said shareholder shall give the Company notice in writing of his/her intention to do so and the reason therefore at least three (3) days prior to the date set for such a meeting.

(2) The Company may refuse to allow a shareholder to split his/her votes, except for the case where the said shareholder has shares in trust or hold shares on behalf of a third party.

Article 30 Exercise of Votes by Proxy

1) Each shareholder may exercise his/her vote by proxy.

(2) In such a case, the proxy shall present to the Company an appropriate document (a power of attorney) evidencing his/her power of representation prior to opening of that meeting.

Article 31 Method of Adopting Resolutions at General Meeting of Shareholders

Unless otherwise provided in the relevant laws and regulations, all resolutions of a meeting of shareholders shall be passed by the affirmative votes of a majority of the shares represented by the shareholders present at the General Meeting of Shareholders, which shall not be less than a quarter of the total number of issued and outstanding shares of the Company.

Article 32 Minutes of Meeting of Shareholders

The proceedings and results of a meeting of shareholders shall be recorded in minutes, which shall be kept in the head office and branches of the Company after chairman and all directors present at the meeting have signed and sealed the same or affixed their signatures thereto.

Article 33 Number of Directors

(1) The Company shall have not less than three (3) directors, but not more than seven (7) directors and the number of outside directors shall be more than a quarter of the total number of directors.

(2) Eight tenth (8/10) of the total number of directors who are not outside directors shall have at least three (3) years of work experience in the Company or the Company’s subsidiaries as officers or employees.

Article 34 Election of Directors

(1) The directors shall be elected at a General Meeting of Shareholders.

(2) Directors shall be elected by a majority of the voting shares held by the shareholders present at the General Meeting of Shareholders, which represents at least one fourth (1/4) of the total issued and outstanding shares of the Company.

(3) When two or more director(s) are required to be elected at a General Meeting of Shareholders, cumulative voting stipulated in Article 382-2 of the Commercial Code shall not apply.

Article 35 Term of Office

(1) The term of office of the directors shall be three (3) years.

(2) Such term of office shall be extended until the close of the Annual General Meeting of Shareholders convened in respect of the last period for the settlement of accounts comprised in their term of office if their term of office expires after the end of the said last period for the settlement of accounts but before the close of the said meeting of shareholders.

Article 36 Election to Fill a Vacancy

(1) If there is a vacancy in the number of directors, a director shall be elected at a meeting of shareholders to fill such a vacancy; provided, however, if the number of the existing directors in office is not less than the number of directors provided in Article 33 hereof and no hindrance is caused to carrying on the Company’s business thereby, the directors to fill a vacancy can be elected at the first meeting of shareholders convened after the vacancy has occurred.

(2) If, as a result of resignation or death of an outside director, there is a vacancy in the number of directors as provided in Article 33 hereof, the requirements concerning such a vacancy shall be met at the first meeting of shareholders convened after such a cause of vacancy has occurred.

(3) The term of a director elected to fill a vacancy shall be the remaining term of his predecessor. However, the term of the director elected under this Article can be set differently by resolutions of the meeting of shareholders.

Article 37 Appointment of Representative Director, etc.

The Company may appoint one (1) representative director and a few executive presidents, executive vice presidents, senior executive directors and executive directors, by resolutions of the Board of Directors.

Article 38 Co-Representative Director(s)

The Company may appoint two (2) or more co-representative director(s) by resolutions of the Board of Directors. In such a case, co-representative director(s) who are appointed by resolutions of the Board of Directors shall exercise the execution of the Company’s business jointly and represent the Company jointly.

Article 39 Duties of Directors

(1) The representative director shall represent the Company and direct the Company’s overall business.

(2) Executive presidents, executive vice presidents, senior executive directors, executive directors and directors shall assist representative director and take charge of the Company’s business as determined by the Board of Directors and, if representative director is absent or unable to execute his/her duties, shall act as representative director in accordance with the order set forth above.

Article 40 Directors’ Obligations to Report

(1) A director shall report the status of executing his/her duties to the Board of Directors at least once every three (3) months.

(2) If a director finds anything that is likely to cause material damages to the Company, he/she shall immediately report the same to auditor(s).

Article 41 Composition of Board of Directors and Convening of Meetings

(1) The Board of Directors shall be composed of directors and make major decisions on the Company’s business.

(2) The Chairman of the Board shall be elected among directors by resolution of Board of Directors.

(3) The Chairman of the Board shall convene all meetings of the Board of Directors by giving notice thereof to each director and auditor(s) two (2) days prior to the date set for each of such meetings. However, the procedure of convening a meeting may be omitted if all directors and auditor(s) unanimously consent to it.

(4) If the Chairman of the Board is absent or unable to serve as presiding officer, representative director, executive presidents, executive vice presidents, senior executive directors shall act as the Chairman of the Board in accordance with the order set forth above.

Article 42 Method of Adopting Resolutions

(1) A quorum for holding a meeting of the Board of Directors shall be a majority of all directors in office and all resolutions of the Board of Directors shall be adopted by the affirmative votes of a majority of directors present at the meeting.

(2) The Board of Directors may allow all directors or a part thereof to participate in resolutions of the Board of Directors through the means of communication transmitting and receiving moving pictures and voices simultaneously, in lieu of attending such a meeting in person. In such a case, such director(s) shall be deemed to have attended such a meeting in person.

(3) No directors having a specific interest in any resolution of the Board of Directors shall be allowed to exercise their vote upon such a resolution.

Article 43 Minutes of Meeting of the Board of Directors

(1) The Board of Directors shall record the proceedings of every meeting of the Board of Directors.

(2) The minutes shall include the agenda, procedure and results of the proceedings of the meeting, names of the directors against each resolution and the reason for their objection thereto and all directors and auditor(s) present at the meeting shall sign and seal the same or affix their signatures thereto.

Article 44 Directors’ Remuneration and Retirement Allowances

(1) Directors’ remuneration shall be determined by a resolution of a meeting of shareholders. Directors’ remuneration shall comprise a basic salary and a performance-based pay, and the amount, terms of payment, method of payment, etc. thereof shall be separately determined by the Company’s regulation concerning payment of remuneration of directors which shall has been duly approved by a resolution of a General Meeting of Shareholders.

(2) Retirement allowances for directors shall be paid in accordance with the Company’s regulation concerning retirement allowances for officers which shall has been duly approved by a resolution of a General Meeting of Shareholders.

(3) The Company may pay extra bonus other than the retirement allowances referred to in Paragraph (2) above to the director at the time of his/her retirement, comprehensively taking into consideration his/her level of contribution to the Company, reason of retirement, etc. Details concerning this matter shall be separately determined by the Company’s regulation concerning such payment which shall has been duly approved by a resolution of a General Meeting of Shareholders.

Article 45 Dismissal of Directors

The Company may dismiss any director before his/her term of office expires; provided, however, such dismissal shall be adopted by at least 80/100 voting shares held by the shareholders present at the General Meeting of Shareholders convened in respect of the resolution for dismissing such director, which number shall be at least one third of the total issued and outstanding shares.

Article 46 Consultants and Advisors

The Company may appoint a few consultants and advisors by a resolution of the Board of Directors.

Article 47 Committees of Board of Directors

(1) The Company may establish committees in the Board of Directors, such as Executive Committee, by a resolution of the Board of Directors.

(2) The details concerning the composition, power and operation of each of such committees shall be determined by resolutions of the Board of Directors.

(3) Articles 42 and 43 shall apply, mutatis mutandis, to such committees.

Article 48 Number of Statutory Auditor(s) and Election

(1) The Company shall have not less than one (1) statutory auditor, among whom not less than one (1) statutory auditor shall be elected as full-timer.

(2) Statutory auditor(s) shall be elected at a General Meeting of Shareholders and resolutions for electing statutory auditor(s) shall be presented to and adopted by a meeting of shareholders, separately from those for electing directors.

(3) Resolutions for electing statutory auditor(s) shall be adopted by the affirmative votes of a majority of the shares represented by the shareholders present at the meeting of shareholders, which shall not be less than a quarter of the total number of issued and outstanding shares. However, if the number of the shares held by any shareholder exceeds 3/100 of the total number of issued and outstanding shares with voting rights, the said shareholder may not exercise his/her voting rights in electing auditor(s) with respect to the shares in excess of such 3/100; provided, however, that, in calculating the number of shares held by a shareholder, the number of shares owned by the largest shareholder and his/her related person(s), those who possess shares for account of the largest shareholder or his/her related person(s) and those to whom the largest shareholder or his/her related person(s) have delegated their voting rights shall be added up together.

Article 49 Term of Office of Statutory Auditor(s)

The term of office of statutory auditor(s) shall be until the close of the Annual General Meeting of Shareholders convened in respect of the last period for the settlement of accounts comprised in his/her term of office, within three (3) years after his/her inauguration as statutory auditor.

Article 50 Election to Fill a Vacancy

If there is a vacancy in the number of statutory auditor(s), a statutory auditor shall be elected at a General Meeting of Shareholders to fill such a vacancy; provided, however, that the foregoing provision shall not apply if the number of the existing statutory auditor(s) in office is not less than the number of auditor(s) provided in Article 48 hereof and no hindrance is caused to carrying on the Company’s business thereby.

Article 51 Statutory Auditor(s)’ Duties and Obligations

(1) Statutory auditor(s) shall audit the Company’s accounting and general operations.

(2) Statutory auditor(s) may attend the meeting of the Board of Directors to represent his/her opinion.

(3) Statutory auditor(s) may request the Board of Directors to convene a Extraordinary General Meeting of Shareholders by submitting a written request stating the business to be dealt with at the proposed meeting and the reason for convening such a meeting.

(4) Statutory auditor(s) may request the Company’s subsidiary(s) to make a report on its (their) operations, if auditor(s) deem it necessary to perform his/her duties. In such a case, if the subsidiary(s) fails to immediately make such a report as requested or auditor(s) deem it necessary to verify the content of the report made by the subsidiary(s), auditor(s) shall have the right to inspect that subsidiary’s operations and status of assets.

Article 52 Minutes of Audit

Statutory auditor(s) shall prepare minutes of audit with respect to the audit conducted by him/her. The minutes of audit shall be signed and sealed by or shall bear the signatures of, the statutory auditor(s) who has conducted such audit.

Article 53 Statutory Auditor(s)’ Remuneration and Retirement Allowances

(1) Statutory auditor(s)’ remuneration shall be determined by a resolution of a General Meeting of Shareholders. Resolutions for determining statutory auditor(s)’ remuneration shall be presented to and adopted by a meeting of shareholders, separately from those for determining directors’ remuneration.

(2) Retirement allowances for statutory auditor(s) shall be paid in accordance with the Company’s regulation concerning retirement allowances for officers which shall has been duly approved by a resolution of a meeting of shareholders.

Article 54 Fiscal Year

The fiscal year of the Company shall commence on January 1 and end on December 31 of each year.

Article 55 Preparation and Maintenance of Financial Statements and Business Report

(1) The representative director of the Company shall prepare and submit to statutory auditor(s) for audit the following documents and their supplementary schedules together with an business report, six (6) weeks prior to the date set for the Annual General Meeting of Shareholders convened for the fiscal year to which such documents are related and, upon statutory auditor(s)’ audit, shall submit the aforementioned documents and the business report to the annual meeting of shareholders:

1. Balance Sheet

2. Income Statement

3. Other documents prescribed by the Enforcement Decree of the Commercial Code which indicate financial status and managerial performance of the Company

(2) The consolidated financial statements shall be included referred to in Paragraph (1) above, if the Company has the duty of recording the consolidated financial statements prescribed by the Enforcement Decree of the Commercial Code.

(3) Statutory auditor(s) shall submit an auditor’s report to representative director (president) at least by one (1) week prior to the date set for such annual meeting of shareholders.

(4) Representative director shall maintain the documents referred to in Paragraph (1) above and supplementary schedules with the business report and the auditor’s report in the head office of the Company for five (5) years and their copies in the branch office(s) of the Company for three (3) years respectively, starting from one (1) week prior to the date set for the Annual General Meeting of Shareholders convened for the fiscal year to which such documents are related.

(5) Upon approval of the Annual Meeting of Shareholders with respect to the documents referred to in Paragraph (1) above, representative director shall promptly give public notice of the Company’s balance sheet and independent auditor’s report.

Article 56 Appointment of Independent Auditor

The Company shall appoint an independent auditor with approval of the Independent Auditor Appointment Committee under the Act on External Audit of Stock Companies, Etc. and shall report appointment thereof to the first Annual General Meeting of Shareholders to be convened following such appointment.

Article 57 Disposition of Profit

The Company shall dispose of the unappropriated retained earnings of each fiscal year in the following order of priority:

1. Legal reserve

2. Other statutory reserves

3. Dividends

4. Voluntary reserves

5. Others

Article 58 Dividends

(1) Dividends may be paid in cash and shares.

(2) If dividends are paid in shares and when the Company has issued more than two classes of shares, dividends may also be paid in any class of shares different from such shares by a resolution of a meeting of shareholders.

(3) The dividends referred to in Paragraph (1) above shall be paid to the shareholders or pledges whose names appear or are duly registered in the list of shareholders as of the end of each fiscal year.

Article 59 Quarterly Dividends

(1) After the commencement of the fiscal year, the Company may pay quarterly dividends to shareholders registered as of the last day of March, June and September pursuant to Article 165-12 of the Act on Capital Market and Financial Investment Business. Quarterly dividends shall be paid in cash.

(2) Quarterly dividends referred to in Paragraph (1) above shall be paid by a resolution of the Board of Directors; provided, however, that such a resolution shall be made within 45 days from the record date specified in Paragraph (1) above.

(3) Quarterly dividends shall be paid within the limit of not exceeding the amount of the net worth shown on the balance sheet as of the end of the immediately preceding period for the settlement of accounts less the amount of the following items:

1. The amount of capital, as of the end of the immediately preceding period for the settlement of accounts;

2. The aggregate sum of the capital reserves and legal reserves appropriated up to the immediately preceding period for the settlement of accounts;

3. Unrealized gains defined under the Enforcement Decree of the Commercial Code;

4. The amount appropriated for dividends by a resolution adopted at the annual meeting of shareholders convened for the immediately preceding period for the settlement of accounts;

5. The amount of voluntary reserves appropriated for specific purposes in accordance with the provisions of the Articles of Incorporation or by a resolution of the meeting of shareholders up to the immediately preceding period for the settlement of accounts;

6. The amount of legal reserves to be appropriated for the current period for the settlement of accounts, as a result of such quarterly dividends; and

7. The sum of quarterly dividends paid in the relevant fiscal year, if any.

(4) If any new shares have been issued prior to the respective record dates specified in Paragraph (1) above following the commencement date of the current fiscal year (including as a result of capitalization of reserves, stock dividends, requests for conversion of convertible bonds to the capital stock and the exercise of warrant with respect to bonds with warrant), such new shares shall be deemed to have been issued at the end of the immediately preceding fiscal year with respect to quarterly dividends hereunder.

Article 60 Statute of Limitation to the Claim for Dividends

(1) If a claim for dividends has not been exercised for five years, the statute of limitation applicable thereto shall expire.

(2) The dividends with respect to which the statute of limitation has expired shall become vested in the Company.

SUPPLEMENTARY PROVISIONS

Article 61 Application of Other Provisions

Matters not provided for herein shall be decided or governed by a resolution of the General Meeting of Shareholders or pursuant to the Commercial Code and other applicable laws and regulations.

Article 62 Bylaws

The Company may establish bylaws required for its management by a resolution of the Board of Directors if such establishment is deemed necessary.

Article 1 Amendment to Articles of Incorporation

Any amendment to these Articles of Incorporation shall require a resolution of the General Meeting of Shareholders.

Article 2 Effective Date

These Articles of Incorporation shall take into effect on the day when the spin-off becomes effective pursuant to the Spin-off Plan dated October 2, 2019. The amendments to Articles 13, 14, 15, 19 and 20 shall take into effect on the enforcement date of the Enforcement Decree of the Act on the Electronic Registration of Stocks, Bonds, Etc. and, until such enforcement, Articles 11, 12 and 16 of the existing Articles of Incorporation shall continue to have full force and effect.

FILA Holdings Corporation (the “Company”) sets forth the “FILA Holdings Corporation Corporate Governance Charter” as a foundation for sustainable management and aims to proclaim and fulfill our commitment to sound governance. The Company intends to establish, maintain and develop transparent and fair governance to enhance corporate value and various stakeholders’ rights and interests.

Article 1. Shareholder Rights

① Shareholders, as owners of the Company, possess the rights including the following which is guaranteed by relevant laws and regulations such as the Commercial Code:

- Right to participate in profit sharing

- Right to attend and vote at the General Meeting of Shareholders (the “GMS”)

- Right to obtain relevant corporation information regularly and in a timely manner

② To protect the utmost rights of shareholders, any matters causing fundamental changes to the existence of the Company and the shareholders’ rights (including mergers, split-off/spin-off, amendments to the Articles of Incorporation and etc.) shall be decided at the GMS.

③ The Company shall provide the shareholders sufficiently in advance with adequate information on the date, time, place and the list of agenda to be dealt with at the GMS. The shareholders may propose the agenda to the GMS in accordance with relevant laws and regulations, and may question or demand explanation on the agenda at the GMS.

④ The Company shall endeavor to adopt shareholder resolutions according to transparent and fair procedures and consider ways to enable the shareholders to easily exercise their voting rights.

Article 2. Equal Treatment of Shareholders

① Each shareholder shall have one vote for each common share registered in his or her name, and the fundamental rights of the shareholders shall not be violated in accordance with the relevant laws and regulations.

② The shareholders shall receive any necessary information from the Company timely, sufficiently and in an easy-to-understand manner.

③ In any of its business dealings, the Company shall not provide special treatment for the reason of being a shareholder and shall protect the shareholders from unfair insider trading or self-dealings.

Article 3. Responsibility of Shareholders

① Shareholders shall make every effort to exercise their voting right proactively for the development of the Company with acknowledgement of the fact that exercising such right can affect the management of the Company.

② The controlling shareholders who have influence on the management of the Company shall act in the best interests of the Company and all shareholders, and shall not inflict losses to other shareholders by abusing its influence.

Article 4. Roles of the Board of Directors

① The Board of Directors (the “BoD”) shall have the comprehensive power over the management of the Company and will make key managerial decisions and supervise the management.

② The BoD shall oversee the corporate risk management systematically, so as to enhance the Company’s long-term values.

③ The BoD may delegate its authority to the representative director or a committee on the matters other than those prescribed by legislations, the Articles of Incorporation or the bylaws of the BoD.

Article 5. Composition of Board of Directors and Appointment of Directors

① The Company shall have three to seven directors to allow active discussion on diverse issues and effective decision-making and shall appoint enough number of outside directors(more than three but less than seven) to perform their duties independently from the management, controlling shareholders and the Company.

② Directors shall be appointed at the GMS and he or she has extensive expertise in the relevant field substantially contributing to the corporate management.

Article 6. Outside Directors

① Through the BoD activities, the outside director participates in the Company’s key decision-making process. As a member of the BoD, the outside director supervises and supports the management.

② Outside directors shall be able to make decisions independently from the management and controlling shareholders and shall not hold excessive position to devote sufficient time for purposes of performing their duties.

③ The Company shall provide the outside directors with information in a timely manner necessary for the performance of their duties to ensure that they understand the actual condition of the management of the Company.

The outside directors may request that the Company promptly provide information necessary for the performance of their duties.

④ If needed, the outside director may receive consultation from external experts through the bylaws for the BoD operation.

Article 7. Operation of the Board of Directors

① In principle, the BoD Meeting should be held four times on a yearly basis. If there is an emergency agenda that needs to be discussed, an interim meeting of the BoD shall be held.

② In order to smoothly manage the BoD, the bylaws for BoD operation should be enacted and implemented which states in detail the BoD’s authority, responsibility and management procedure.

③ The proceedings and results of the BoD meeting shall be recorded concretely and clearly in minutes, which shall be kept and maintained.

Article 8. Sub-Committees under the Board of Directors

① The BoD may establish and operate sub-committees in order to assist swift and efficient decision making stipulated in the Articles of the Incorporation.

② The BoD may delegate its authority to sub-committees other than those prescribed by the Articles of Incorporation.

Article 9. Duties and Responsibilities of Directors

① The directors shall perform their duties with the duty of care of a good manager. Directors shall do their utmost in performing their duties with prudence and faithfulness for the best interests of the Company and its shareholders.

② Directors shall not divulge or use any information obtained during the term for their own or any third parties’ benefit and shall abide by all the Company’s policies as a member of the Company.

③ The directors shall make reasonable decisions based on sufficient information by devoting adequate time and effort. But managerial decisions by the director that are based on good faith and rational judgement shall be respected.

Article 10. Evaluation and Compensation

① The managerial activities of the management shall be fairly evaluated, and the evaluation results shall be reasonably reflected in the remuneration.

② Compensation of directors shall be executed to the extent approved at the GMS.

Article 11. Internal Audit Body

① The Company shall perform accounting and audit activities prescribed by legislations, the Articles of Incorporation or the internal audit policy through internal statutory auditor and the supporting body.

② The statutory auditor shall have the right to attend the BoD meeting and inspect directors’ general operations independently. The auditor shall be able to approach important corporate information in an appropriate manner according to the bylaws for the auditor's duties and responsibilities.

③ The Company shall be able to establish the audit committee to carry out accounting and audit activities prescribed by the Articles of Incorporation and set forth and operate the bylaws for audit committee operation.

Article 12. External Auditor

① External auditor shall perform fair audits independently from the Company, its management and controlling shareholders.

② External auditor shall be able to attend the GMS and answer any shareholders' questions on the audit reports.

③ External auditor shall engage to identify any misconduct or unlawful act committed by the Company during the audit.

Article 13. Protection of Rights of Stakeholders

① The Company shall endeavor to ensure corporate stewardship for various stakeholders including customers, employees, suppliers, local communities, so as to enhance the Company’s long-term values.

② The Company shall endeavor to protect the rights of stakeholders by the laws, regulations or contract. In particular, the Company shall make efforts to faithfully observe the labor-related laws and regulations such as the Labor Standard Act, and maintain and improve its labor conditions.

③ To the extent permitted by law, the Company will provide information necessary for protection of the rights of stakeholders, and shall support the stakeholders’ access to the relevant information as much as possible.

Article 14. Disclosure

① The Company shall prepare and disclose the business report, quarterly report, biannual report, etc. on a regular basis, and shall disclose information relating to corporate matters to the shareholders and interested parties sincerely, promptly.

② The Company shall designate an officer in charge of disclosure in accordance with the bylaw for the disclosure information management, and shall establish an internal information delivery system through which the Company’s important information can be delivered swiftly to the officer in charge of disclosure.

③ The Company shall endeavor to make the disclosure easy to understand and make it easily available to the stakeholders.

④ The Company shall not prioritize nor unfairly discriminate against anyone on the scope or the timing of the disclosure, and the disclosure shall be prepared in a manner that all stakeholders can simultaneously have access to the information.

⑤ The Company shall establish and announce the code of conduct and disclose the policy to the Company webpage.

Addenda

This corporate governance charter shall take into effect from June 16th 2021 upon the approval of the Board of Directors.